hs tariff classification for canada skid steer The Canada Tariff Finder enables Canadian businesses to check import or export tariffs for specific goods and markets, with a focus on countries with which Canada has a Free Trade Agreement. The tool shows the tariff rates generally applicable to all nations. John Deere 50. 39 hp. 9270 lb. Compare. View updated Kubota KX040-4 Mini Excavator .

0 · hs codes for canada

1 · cbsa customs tariff canada

2 · canadian tariffs

3 · canadian tariff finder 2022

4 · canadian import tariff finder

5 · canadian customs tariffs

6 · canadian customs hs codes

7 · canada hs code search

earthmoving and compaction equipment, with much larger footprints and weight, could .

The Canada Tariff Finder enables Canadian businesses to check import or export tariffs for specific goods and markets, with a focus on countries with which Canada has a Free Trade Agreement. The tool shows the tariff rates generally applicable to all nations.

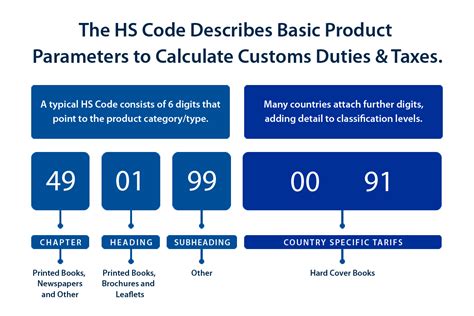

Find the Harmonized System (HS) code for your product and the applicable tariff rate for . Find tariff classifications for goods you want to import into Canada based on the .

Search for the 6-digit HS code of any product using Canada Post's online tool. You can also .

Find tariff and duty information, sanctions, export and import controls and other rules that affect .The Canada Tariff Finder enables Canadian businesses to check import or export tariffs for specific goods and markets, with a focus on countries with which Canada has a Free Trade Agreement. The tool shows the tariff rates generally applicable to all nations.Find the Harmonized System (HS) code for your product and the applicable tariff rate for exporting to different countries. Learn about the HS classification system, the Canadian customs tariff, and the trade agreements and rules of origin.Find tariff classifications for goods you want to import into Canada based on the Harmonized System. Access the current and previous Customs Tariff files, rulings, guides, and notices.

Search for the 6-digit HS code of any product using Canada Post's online tool. You can also view special requirements, duty and tax information, and trade glossary for your destination.Find tariff and duty information, sanctions, export and import controls and other rules that affect Canadian traders. Learn how to register a trade barrier, understand the legal side of international trade, and access resources for goods with HS codes.

Learn how to classify goods imported into Canada using the Harmonized Commodity Description and Coding System (HS) and the Customs Tariff. Find resources, rules, legal notes and examples to help with tariff classification.

hs codes for canada

cbsa customs tariff canada

mini digger hire irlam

Learn how to use the Harmonized System (HS) to classify goods imported into Canada. Find out the legal text, rules, chapters, headings, and sections of the Canadian Customs Tariff.Quickly get tariff information for specific products and countries where Canada has a Free Trade Agreement. Our Canada Tariff Finder tool is so intuitive, it gives tariff rates even without the HS code. Importing heavy equipment from Canada is beneficial due to its geographic closeness, easy communication, USMCA perks, and efficient shipping routes. You’ll need to follow the EPA’s emission requirements for the engine in your heavy equipment import.

Harmonized System Code (HS codes) or HTS Code and Tariff Classification for front end skid loaders.The Canada Tariff Finder enables Canadian businesses to check import or export tariffs for specific goods and markets, with a focus on countries with which Canada has a Free Trade Agreement. The tool shows the tariff rates generally applicable to all nations.Find the Harmonized System (HS) code for your product and the applicable tariff rate for exporting to different countries. Learn about the HS classification system, the Canadian customs tariff, and the trade agreements and rules of origin.

Find tariff classifications for goods you want to import into Canada based on the Harmonized System. Access the current and previous Customs Tariff files, rulings, guides, and notices.Search for the 6-digit HS code of any product using Canada Post's online tool. You can also view special requirements, duty and tax information, and trade glossary for your destination.

Find tariff and duty information, sanctions, export and import controls and other rules that affect Canadian traders. Learn how to register a trade barrier, understand the legal side of international trade, and access resources for goods with HS codes.

Learn how to classify goods imported into Canada using the Harmonized Commodity Description and Coding System (HS) and the Customs Tariff. Find resources, rules, legal notes and examples to help with tariff classification. Learn how to use the Harmonized System (HS) to classify goods imported into Canada. Find out the legal text, rules, chapters, headings, and sections of the Canadian Customs Tariff.Quickly get tariff information for specific products and countries where Canada has a Free Trade Agreement. Our Canada Tariff Finder tool is so intuitive, it gives tariff rates even without the HS code.

Importing heavy equipment from Canada is beneficial due to its geographic closeness, easy communication, USMCA perks, and efficient shipping routes. You’ll need to follow the EPA’s emission requirements for the engine in your heavy equipment import.

mini digger hire melksham

canadian tariffs

The CASE CX60C proves that giants come in all sizes. After all, this big mini excavator weighs just six metric tons, but it kicks out industry-leading horsepower along with nearly 9,200 lbs. of breakout force.

hs tariff classification for canada skid steer|cbsa customs tariff canada